Bay Bridge Salary Reduction Agreement (SRA)

- Download the Salary Reduction Agreement document here.

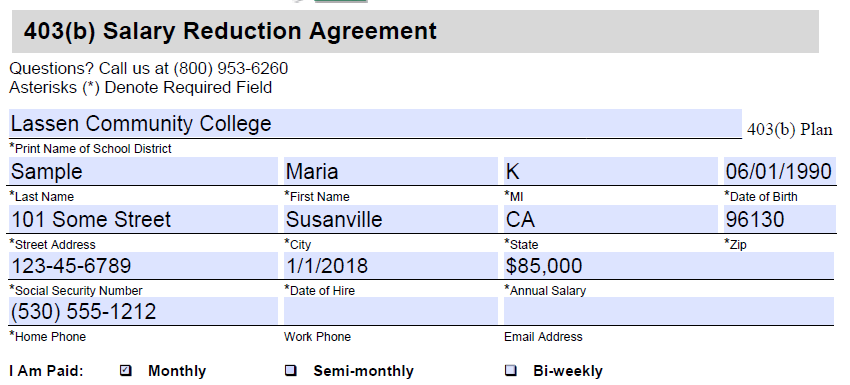

- Fill in your employer's name and your personal information as shown in the example below.

- Make sure to check the correct pay period checkbox (monthly, semi-monthly or bi-weekly)

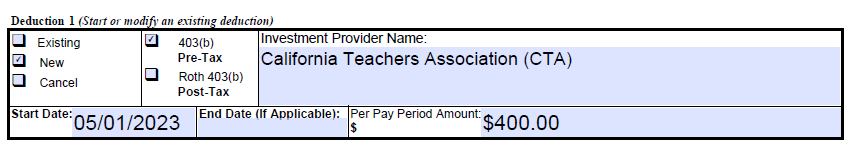

You have three choices for your contribution instruction:

- Existing means you are already contributing to the CTA 403(b) and you want to change how much you are contributing.

- New means you are contributing to the CTA 403(b) for the very first time.

- Cancel means you want to stop your current contribution to the CTA 403(b)

Next you are deciding if you want to contribute pre-tax or after-tax (Roth) to your account:

- Pre-tax means your contributions will happen before any taxes are taken out. It will lower your current income tax for the year. However, when you take monies out in retirement, your distributions will be taxable as ordinary income.

- Post-tax (Roth) means you are paying your taxes on this income upfront. It will not lower your taxable income this year. However, when you take money out of your Roth account in retirement, all distributions are tax-free.

Consult with your tax advisor to determine which tax election is in your best interest. - Write "California Teachers Association (CTA)" in the "Investment Provider Name" box.

- For the "Start Date", please use the date you fill out the document.

- Leave the "End Date" box blank.

- Finally, tell the administrator how much you want to contribute each pay period. In the sample form, we have indicated a monthly contribution of $400.

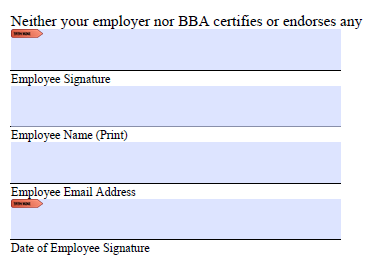

- Proceed to the next page and sign and date the document and complete the "Employee" fields on the left. Leave the "Agent" fields blank.

- Once you have completed the document, please fax the document to the administrator.

NOTE: Do not email the document since this will expose your personal information on the internet.

If you have any questions about this document, please contact Bay Bridge Administrators at 800.956.6260