TDS Salary Reduction Agreement (SRA)

- Visit https://tdsplans.org

- Select "California" in the "EMPLOYER STATE" dropdown and start typing the first few letters of your employer's name in the "EMPLOYER NAME" field.

Once your employer shows up below the text field, select it and click/tap “Show Details” button.

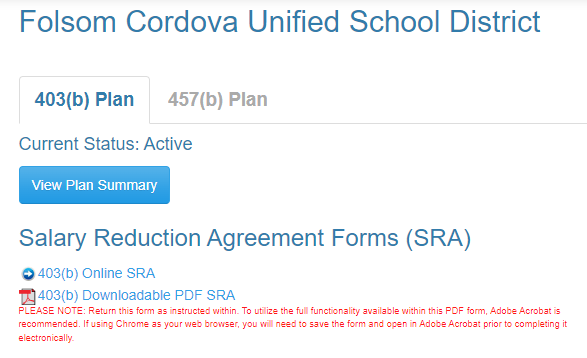

- Upon accessing the dedicated page for your employer, you will be able to select either an online SRA or a downloadable PDF SRA.

If your employer provides an online SRA option, please click on "403(b) Online SRA" link. Otherwise, click on "403(b) Downloadable PDF SRA".

Instructions for the Online SRA Form

- Click on the "403(b) Online SRA" link.

- Enter your date of hire.

- Check "Please check here if you have contributed to another 403(b), 401(k) or 401(a) plan this calendar year." checkbox if you have contributed to another plan this calendar year, otherwise leave unchecked.

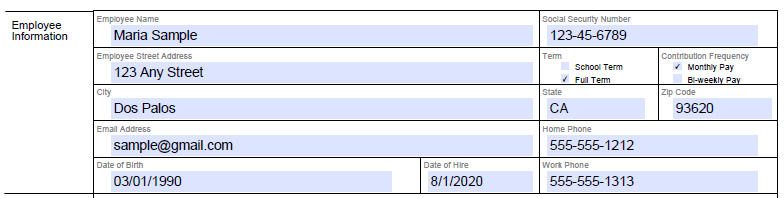

- Fill out the "Employee Information" section.

- NOTE: Leave "There is a financial advisor/representative associated with this transaction" checkbox unchecked. No one is making a commission on the CTA 403(b).

- Select the first checkbox “Begin or Change Contributions to a 403(b) Account”.

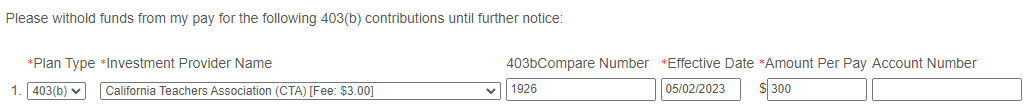

- Under "Plan Type", select either 403(b) or ROTH (if offered).

- Select "California Teachers Association (CTA)" under "Investment Provider Name".

- " 403bCompare Number" should auto-populate to "1926".

- Click the Effective Date box and select today’s date.

- Enter either a dollar amount in the "$" field or the percentage in the "%" field (if available for your district).

- The "Account Number" field is not required, but if you have your CTA account number, please fill it in.

- Only check "Please check here if you are NOT a full-time employee" checkbox if you are not full-time employee, otherwise leave unchecked.

- Re-enter your social security number at the bottom of the screen and click "Continue".

If everything is correct, you will see the "Submission Confirmation" page. You are done!

Instructions for the Paper SRA Form

NOTE: You need your CTA 403(b) account number in order to complete this paper form. You can get your account number by logging in to your CTA 403b account.

- Click on the "403(b) Downloadable PDF SRA" link and download the PDF.

- Open the PDF, go to page 3 and complete the “Employee Information” section.

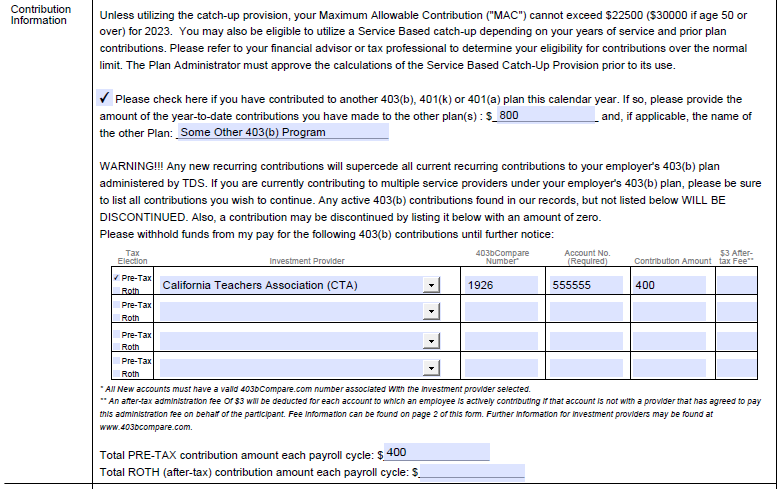

- Check "Please check here if you have contributed to another 403(b), 401(k) or 401(a) plan this calendar year." checkbox if you have contributed to another plan this calendar year, otherwise leave unchecked.

- In the "Tax Election" box, check either "Pre-Tax" or "Roth" (if available for your employer) checkbox.

- Enter "1926" in the "403bCompare Number" box.

- Enter your CTA 403b account number in the "Account No. (Required)" box.

Your CTA account number will be available 2 business days after you sign up for your account. - Enter the amount you want to contribute each payroll cycle in the "Contribution Amount" box.

- NOTE: TDS charges $3 per month to process your contributions.

If you put $3 in the "$3 After-tax Fee**" box, an extra $3 will be taken out of your paycheck to pay TDS. Otherwise, TDS will deduct it from your Contribution Amount. - Enter the total Pre-tax and ROTH amounts in the appropriate boxes at the bottom of the "Contribution Information" section.

- Leave "Financial Advisor Information" blank. No one is making a commission off of your CTA 403(b) account.

- Turn to Page 4 and sign and date the document.