EBSA Salary Reduction Agreement (SRA)

Employee Benefits Services & Advisors, Inc.

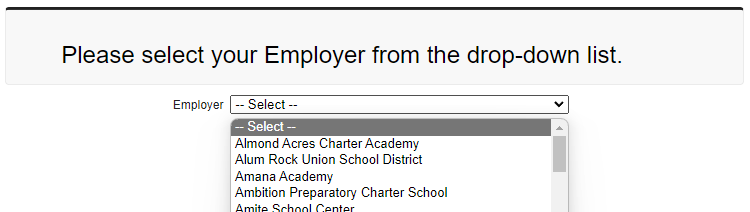

- Visit https://altamontclair.org/salary-reduction-agreements-sra/

- Select your employer from the drop-down list.

We will select "Alum Rock Union School District" for this example.

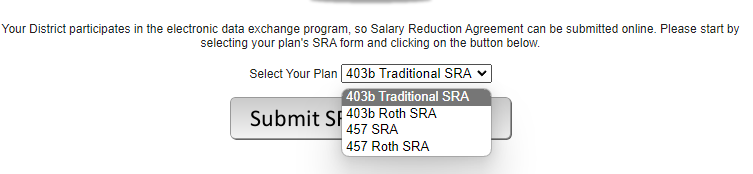

- If your district participates in the electronic data exchange program, you will see "Submit SRA Form Online" button.

- You will also be presented with a "Select Your Plan" drop-down menu which will have options specific to your district. You will need to choose between "403b Traditional SRA" and "403b Roth SRA".

- A traditional 403(b) lowers your current taxable income with pre-tax contributions. Withdrawals in retirement from a traditional 403(b) are taxable as ordinary income.

- With a ROTH 403(b) contributions are made on an after-tax basis. It will not lower your taxable income. However, withdrawals made in retirement are tax-free.

- Consult with a tax advisor to determine which type of contribution is in your best interest.

- If your district does not participate in the electronic data exchange program, "Submit SRA Form Online" button will not be available. PDF forms specific to your district will be listed and you will need to download and fill out an appropriate PDF form (traditional or ROTH).

Instructions for the online form

• Only check the checkbox on top ("I have active account(s) with the Financial Companies (Vendors) specified...") if you are actively contributing to another 403(b) in your school district. Otherwise, leave this box unchecked.

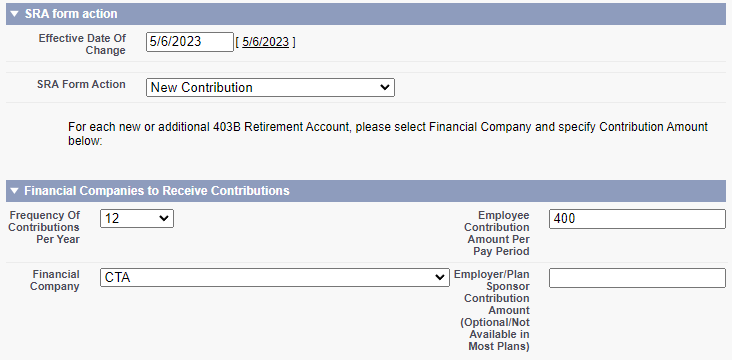

• Select today’s date for "Effective Date of Change".

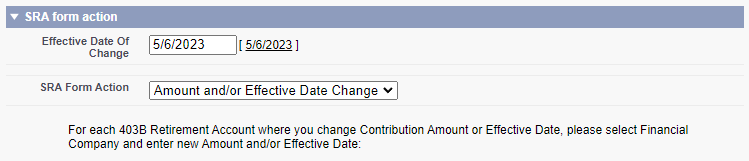

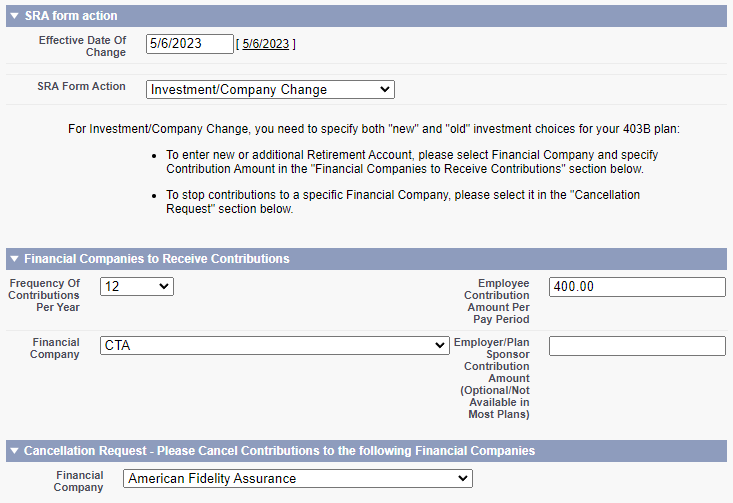

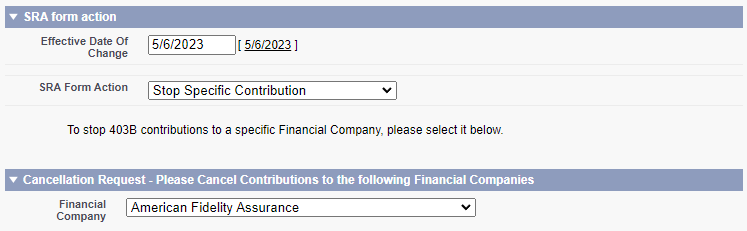

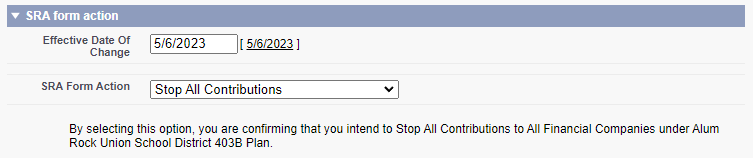

Pay special attention to "SRA Form Action" drop-down. There are a number of choices you can select.

- Frequency of contributions: match the number of payrolls per year with the number you select. For example, if you are paid monthly (12 times per year) then select 12.

- Employee Contribution Amount Per Pay Period = how much you want to contribute to your 403(b) each paycheck. For example, $400.

- Financial Company = CTA or California Teachers Association.

- Employer/Plan Sponsor Contribution Amount = Leave blank unless you know your employer matches. Most do not.

- Frequency of contributions (match the number of payrolls per year with the number you select. For example, if you are paid monthly (12 times per year) then select 12.

- Employee Contribution Amount Per Pay Period = how much you want to contribute to your 403(b) each paycheck. For example $400

- Financial Company = CTA or California Teachers Association

- Employer/Plan Sponsor Contribution Amount = Leave blank unless you know your employer matches. Most do not.

- Frequency of contributions (match the number of payrolls per year with the number you select. For example, if you are paid monthly (12 times per year) then select 12.

- Employee Contribution Amount Per Pay Period = how much you want to contribute to your 403(b) each paycheck. For example, $400.

- Financial Company = CTA or California Teachers Association.

- Employer/Plan Sponsor Contribution Amount = Leave blank unless you know your employer matches. Most do not.

- Under "Cancellation Request" section, for the "Financial Company" drop-down, please select the company where you want to stop making 403(b) contributions.

- From the dropdown menu please select the company where you want to stop making 403(b) contributions.

Stop All Contributions – only select this option when you are contributing to two or more 403(b) accounts, and you want to stop all contributions.

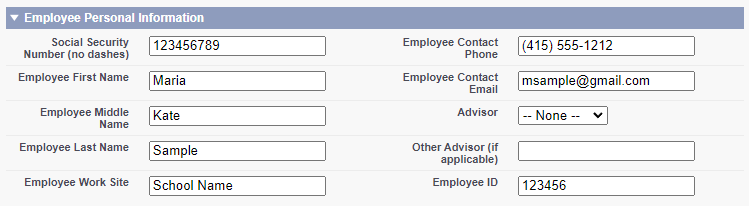

- Complete "Employee Personal Information" section.

- Make sure "None" is selected for "Advisor". This section is used to pay commissions to advisors. With the CTA 403(b), our advisors do not earn a commission.

- Also leave the "Other Advisor" field blank as well.

• Once you have completed the document, check the "I hereby request and authorize..." checkbox and then click the "Submit" button at the bottom of the page.