Envoy Salary Reduction Agreement (SRA)

You don't have to complete a separate SRA when enrolling online for the CTA 403(b) plan because Envoy SRA is already integrated.

There are two situations when you do need to complete a separate SRA:

- If you district is not integrated (you will be notified during the enrollment process).

- If you wish to change your contributions after your initial enrollment.

Online SRA Instructions

NOTE: The SRA information entered via the online system will supersede and replace all prior 403(b) and/or 457(b) elections including the amounts, investment providers, and effective dates. Any election(s) you want to continue must be reflected or the election will be stopped.

- Visit https://envoy.tsacg.com/SRA/index.php.

- Click on "START TRANSACTION" button.

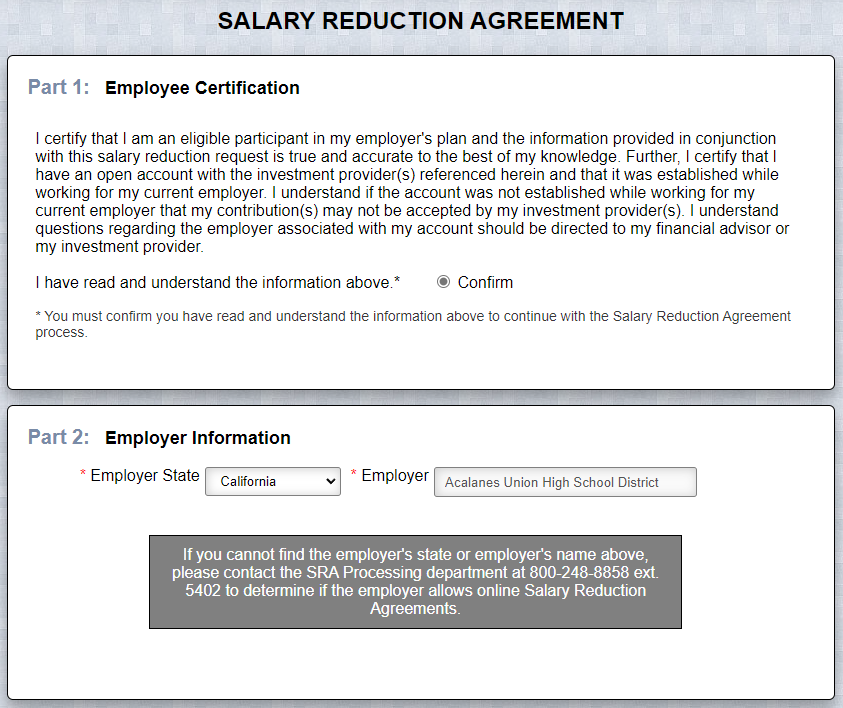

- Check "Confirm" radio button under "Part 1: Employee Certification section.

- Select "California" in the "Employer State" drop-down.

- Select your employer in the "Employer" drop-down. If your employer is not listed, contact the SRA Processing department at 800-248-8858 ext. 5402.

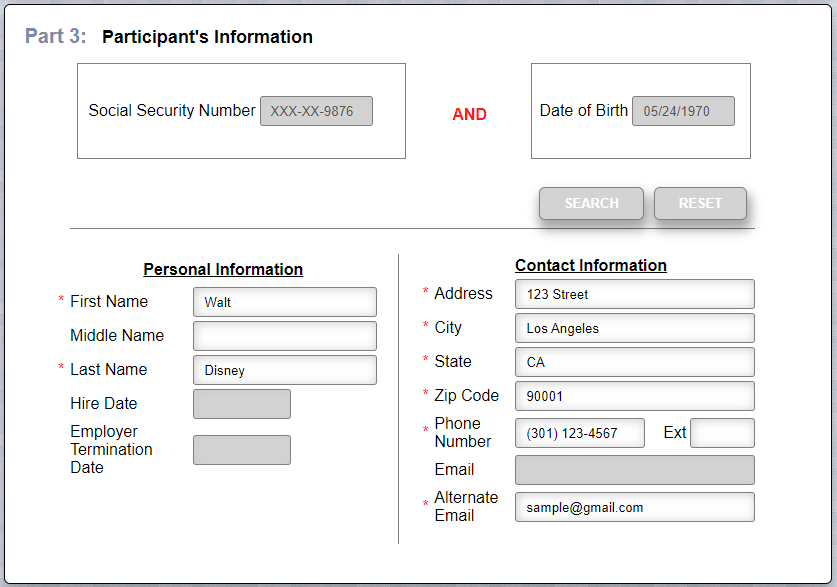

- Type in your SSN and date of birth.

- If you have previously entered SRA information or Envoy has your demographic information archived in their system, most of your personal information will pre-populate.

- If your information is not currently in Envoy’s system, you will be able to add your record.

You have the ability to start, change, or stop contributions.

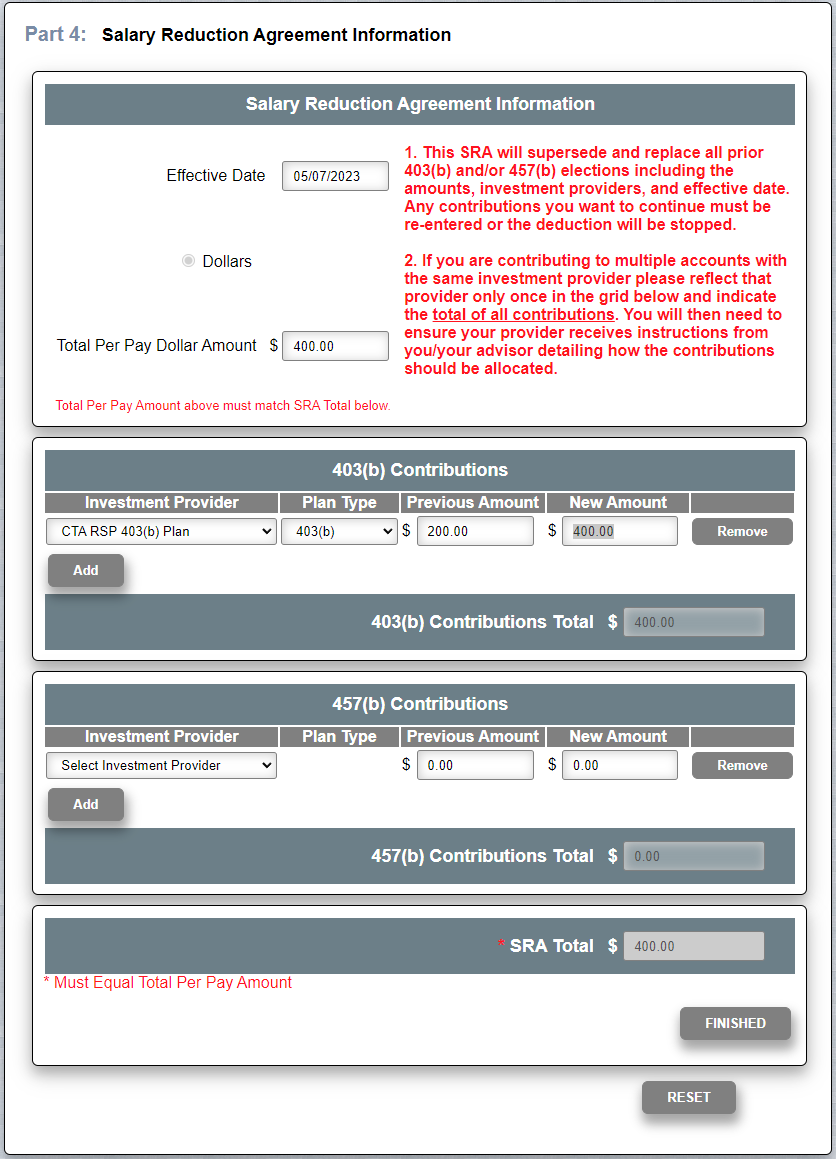

- Effective date = today’s date.

- "Total Per Pay Dollar Amount" = How much you want to contribute each pay period… for example, $400.

- Under "Investment Provider", select "CTA RSP 403(b) Plan.

- Select "403(b)" or "403(b) Roth" under "Plan Type".

- If you are just starting your CTA 403(b) contributions, you just need to fill in the "New Amount".

- If you are changing your contribution, you need to type in your current contribution under "Previous Amount" and the desired contribution under "New Amount".

- If you want to stop making contributions, fill in the current contribution amount under "Previous Amount" and put $0 under "New Amount".

- NOTE: Make sure "Total Per Pay Dollar Amount" is same as the "New Amount".

- When you are done, click "FINISHED" button.

- Check "I have read and and agree to the terms above." checkbox under "Salary Reduction Agreement Terms" section.

- Check "By checking this box you agree to the following" checkbox under "Disclosures" section.

- Check "I am not a robot" checkbox.

- Click "SUBMIT" button.