NBS Salary Reduction Agreement (SRA)

You don't have to complete a separate SRA when enrolling online for the CTA 403(b) plan because NBS SRA is already integrated.

There is one situation when you do need to complete a separate SRA:

When you wish to change your contributions after your initial enrollment.SRA Instructions

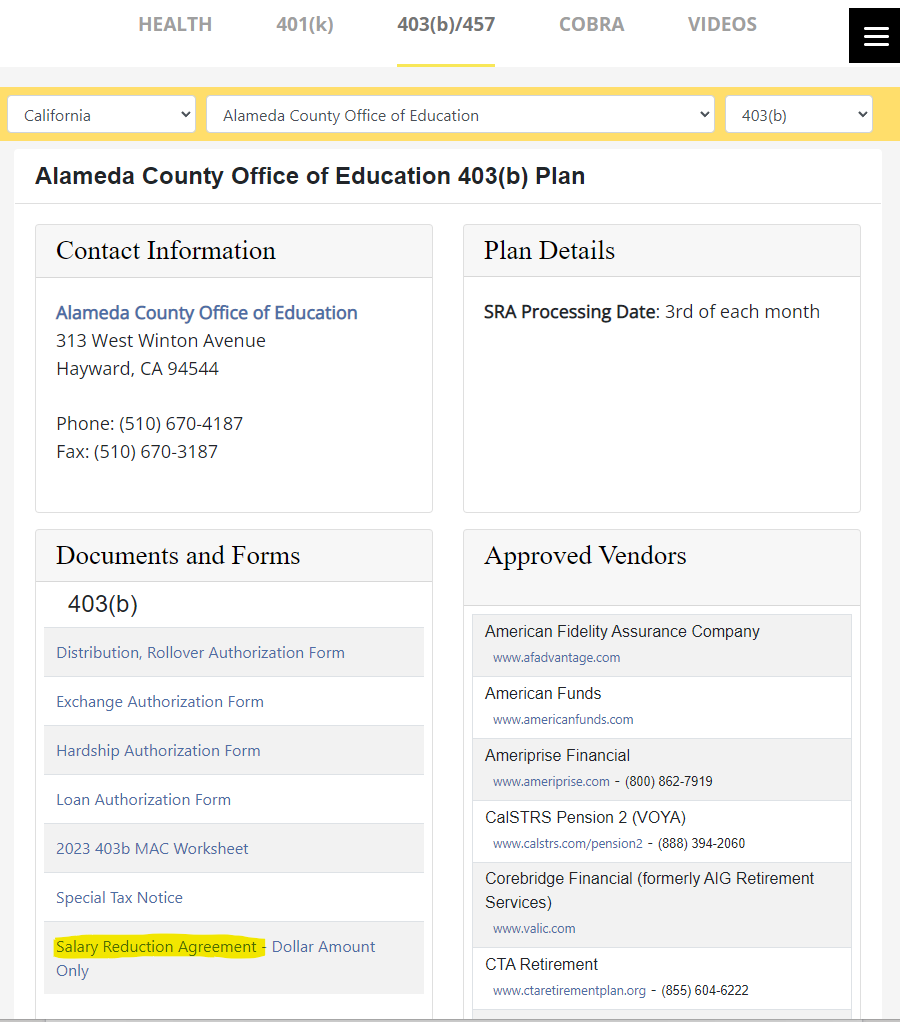

- Visit https://www.nbsbenefits.com/non-erisa-403b-forms/.

- Select "California" from the state drop-down.

- Select your employer from the "Employer" drop-down.

We selected Alameda COE in this example. - Select "403(b)" in the "Select a Plan" drop-down.

The page will show the information specific to your employer.

- Click on the "Salary Reduction Agreement" link under "Documents and Forms" section.

- Save the SRA PDF document that comes up

- Page 1 of the document provides general information and instructions.

Additionally, it provides contact information for any assistance you may need with the document and the fax number where you should send the completed form.

Proceed to the page 2 of the document.

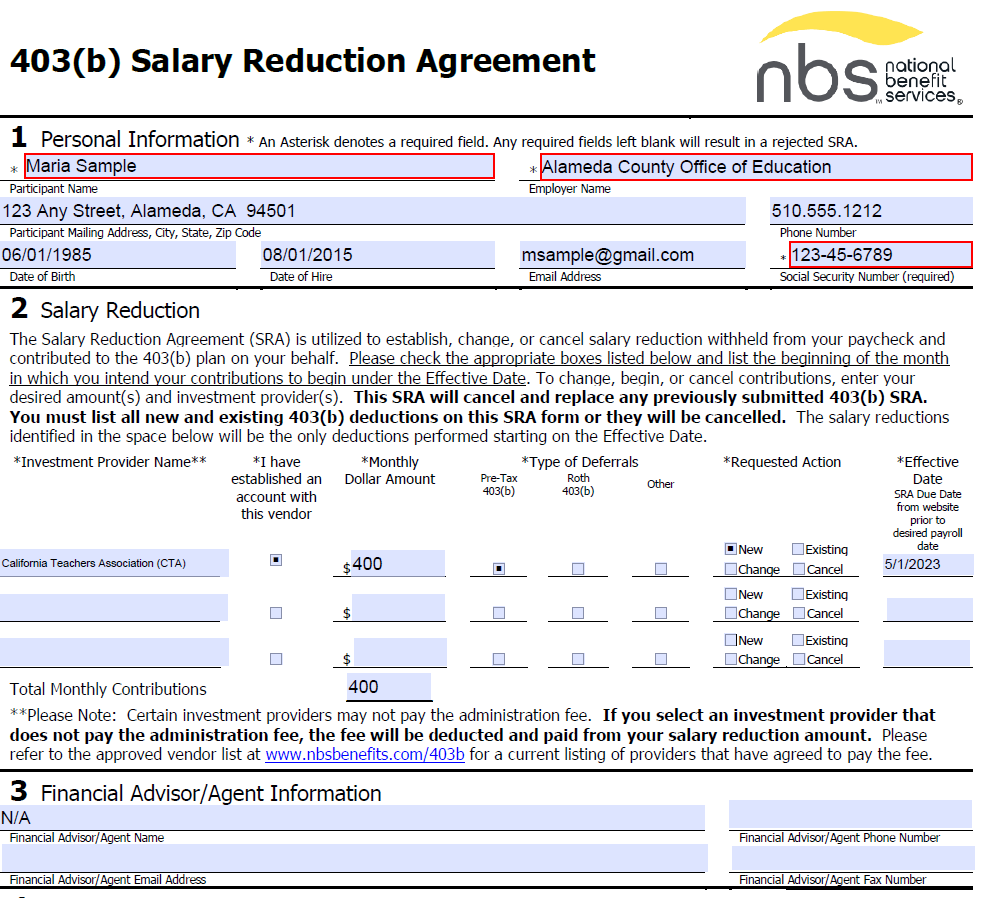

- Fill in your information under "Personal Information" section.

- Write "California Teachers Association (CTA)" in the "Investment Provider Name" box.

- Check "I have established an account with this vendor" checkbox.

- Put the amount you want to contribute in the "Montly Dollar Amount" box. For example, $400.

- Check "Pre-Tax 403(b)" or "Roth 403(b)" checkbox.

Pre-tax 403(b) lower your current taxable income with pre-tax contributions. Withdrawals in retirement from a traditional 403(b) are taxable as ordinary income.

ROTH 403(b) contributions are made on an after-tax basis. It will not lower your taxable income. However, withdrawals made in retirement are tax-free.

Consult with a tax advisor to determine which type of contribution may be in your best interest. - Select one of the "Requested Action" checkboxes:

Select New if this is your first contribution to your CTA 403(b) account.

Select Existing ONLY if you are not changing your CTA 403(b) account contribution but you are adding another 403(b) contribution to a different vendor

Select Change if you are changing the amount you are contributing to your existing CTA 403(b) account. For example increasing your monthly contribution.

Select Cancel if you wish to stop contributing to your existing CTA 403(b) account.

- Put today's date in the "Effective Date" box.

- Make sure to complete the "Total Monthly Contributions Amount".

- Please leave the Financial Advisor section blank. This section is used to pay advisors/agents commissions and the CTA program does not pay commissions. Our advisors are fiduciaries who do not accept commissions.

- The final step to completing this document is to sign and date it.

- Once you have completed the document, fax it to NBS at 800.597.8206 for processing.

It is advisable to call NBS to verify they received the fax.

You can contact NBS by telephone at 800.274.0503 extension 5.