PlanConnect Salary Reduction Agreement (SRA)

You need to complete PlanConnect SRA when you:

- Enroll in the CTA 403(b).

- Wish to change your contributions.

PlanConnect offers a paper SRA form.

You can get the SRA form from your payroll or HR department at your school district, or you can download it from 403bcompare.com:

- Visit 403bcompare.com.

- Click on "FIND EMPLOYER" top menu.

- Enter your employer's name in the search box.

- Click on your employer's name link in the search results list.

- Click on "Salary Reduction Agreement" link in the "Initiate or Change Contributions" box

SRA Form Instructions

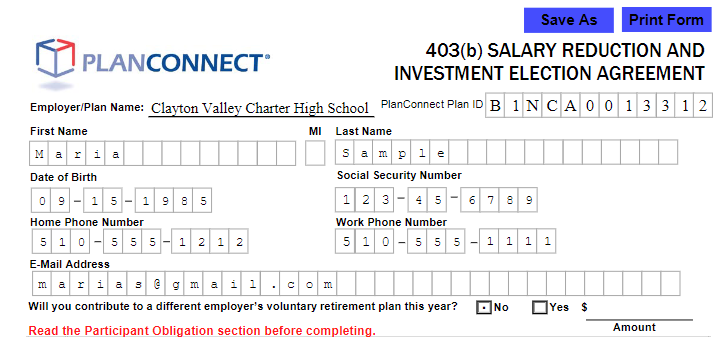

- Make sure your employer’s name is at the top of the document.

- Fill in your personal information as shown in the example below.

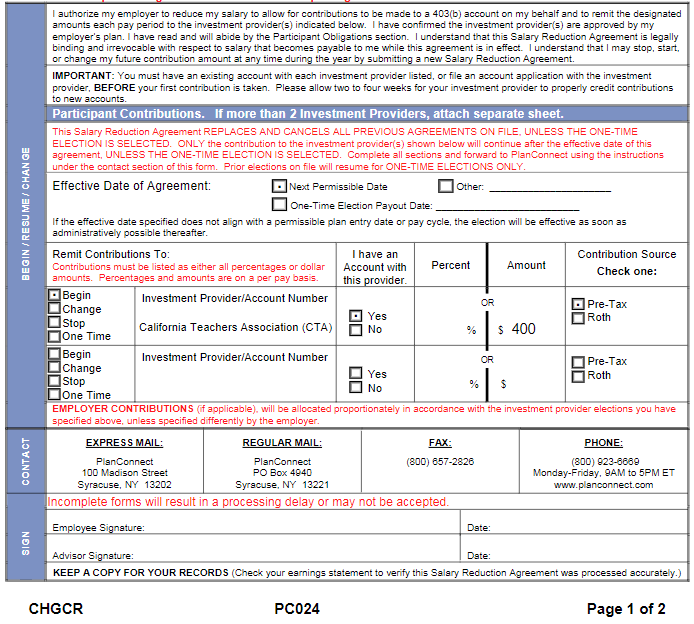

- Check "Next Permissible Date" checkbox for the "Effective Date of Agreement".

- Select the appropriate checkbox for the transaction type:

Begin = check this box if you are contributing to your CTA 403(b) for the first time.

Change = Select this box if you want to change the amount you are contributing to your existing CTA 403(b) account.

Stop = Only select this option if you wish to stop contributing to your CTA 403(b) account.

One Time = Only if you are making a one-time contribution to your account.

- Select "Yes" under "I have an Account with this provider".

You have a choice of how much to contribute:

- A percent of your paycheck. For example, if you make $5,000 per month and you select 5%, then you would contribute $250 per month.

- A flat dollar amount per pay period. For example, you want to contribute $400 per month into your CTA 403(b) account each month.

Check "Pre-Tax 403(b)" or "Roth 403(b)" checkbox.

- Pre-tax 403(b) lowers your current taxable income with pre-tax contributions. Withdrawals in retirement from a traditional 403(b) are taxable as ordinary income.

- ROTH 403(b) contributions are made on an after-tax basis. It will not lower your taxable income. However, withdrawals made in retirement are tax-free.

Consult with a tax advisor to determine which type of contribution may be in your best interest.

At the bottom of the page, sign and date the form.

You do not need an advisor signature - you can write in N/A on that line.

An advisor signature is only required when someone is earning a commission on your transaction. The CTA program does not charge a commission and no advisor is making a commission.

Once you complete the form, you need to send it to the Third Party Administrator (TPA) for your district.

Right above your signature are various ways to send the document to them. The preferred method is Fax.